Direct Debiting |

This service was launched in December 2001, and it is used to make periodic payments, such as installments for acquisition of goods and services, subscriptions, membership fees, and so forth.

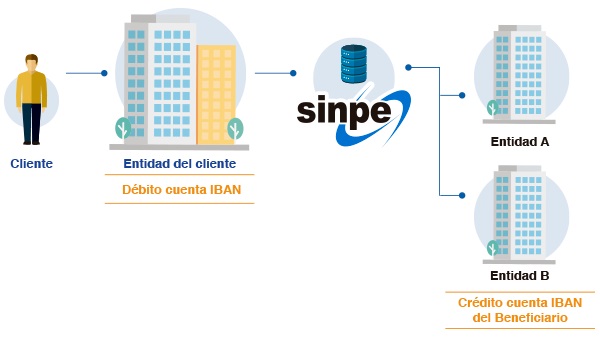

It is designed for individuals and juridical persons to do periodic, large-scale collections through their financial entities, from their clients’ accounts for the sale of goods or services, regardless of the geographical location of their debtors and of their financial entity.

To process payments, a debtor only has to authorize debiting from their account, in keeping with the characteristics agreed with the vendor. This is done through a Direct Debiting Authorization (orden de domicialiación.) The fee charged for this service depends on the financial entity where the procedure is done. Each entity has its own fees, which may be consulted on the Fees & Charges section, at Fees Charged by Financial Entities. |

Using this service

The Direct Debiting Service may be used for periodic, large-scale collections, for example:

• Credit sales

• Utilities (Electricity, water, telephone, Internet)

• Rentals

• School/university tuition fees

• Subscriptions/memberships (newspapers, gym, magazines, clubs.)

• Insurance

• Articles sold on credit

• Accounts receivable

• Loans

• Credit cards, etc.

Advantages

For the individual/juridical person collecting the payment:

• Collections can be made in an easy, timely fashion: The providers of goods or services are not forced to keep and account at the same financial entity as their clients, since such collections can be made between different financial entities.

• Funds are safely received: Collected funds are received electronically, thereby eliminating the risk of theft and robbery, as opposed to traditional methods such as cash and checks.

• Regulation of terms for fund crediting - If funds were not credited to your account at the time defined in the corresponding regulations, a client may file a claim.

• Accounts receivable are kept up to date: Because there is no need to wait for clients to make their payments, but instead are collections processed on a specified date, there will be less of a chance for backlogs in your accounts receivable, while also reducing the cost of collecting them after the agreed date.

For the physical/juridical person making a payment:

• More efficiency in payments - A customer obtaining a good or service for which it has to make periodic payments should do a Debiting Authorization procedure only once, so that providers can collect their payments without the customer having to go physically or move any cash. Hence the savings in cost such as paying a person to make the payment through conventional methods, generation of interest due to delinquency payments, and the opportunity cost due to suspension of a service.

• More geographical coverage: Debiting authorizations may be requested anywhere in the country and with any financial entity where interested parties may keep their accounts, since this system has country-wide coverage.

• Risk of loss and theft is eliminated, as payments are made electronically and automatically.

Working hours

The Direct Debiting service operates on SINPE’s working days, within a 2 working-day cycle. This means that for any payment collection processed through your financial entity on any given day, funds will be available in your account by 10:00 am of the following working day at most.

Example of use

You go shopping using your credit card, and therefore each month you have to actually have to go to the issuing financial entity to make your payment. This means you have to spend time and money on this on a regular basis, aside from the risk involved in moving with the cash.

To prevent this situation, you come to an agreement with the card’s issuer, authorizing it to automatically debit the amount from your Cuenta Iban every month. This way, you will not incur in interest due to delinquency payments, as your credit will be up-to-date, while the issuing financial entity will also make its collections regularly and in a cost-effective manner.

Related documents

• System of Payments Regulations (spanish)