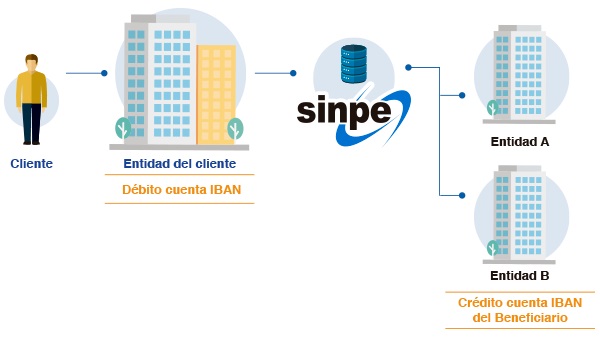

Launched in June 2001, this service is designed so that individuals and juridical persons may do, through their own financial entity, large-scale payments to any Cuenta Iban, regardless of the geographical location of the financial entities where such payments are to be processed. To do payments by means of this service, you only have to send an electronic file to your financial entity in the format your financial entity may indicate, including detailed information on the payment(s) to be done such as: • Cuenta Iban were funds are to be deposited (Beneficiary) • Identification of the addressee (Beneficiary) and of the sender (Payor). The fee charged for this service is determined by the financial entity processing the transaction. Fees may be checked on the section on Fees and Charges, under Fees charged by financial entities. Using this service

The Direct Crediting service may be used to make periodic, massive payments, for example: • Payrolls

• Pension lists

• Payments to providers

• Any other periodic and massive payments

• This service is convenient for doing periodic payments, since, SINPE offers the Transfers to Third Parties service for periodic sporadic payments to be done online. AdvantagesFor the individual/juridical person processing the payment:

• Regular payments - A client may establish business relations with providers, or pay salaries, without them having to have an account with the same financial entity, since payments are made to any account as indicated.

• More efficiency in payments - All you need to do is send an electronic file to your financial entity with the "payroll" or list of payments to be made, in the format and other requirements defined by the financial entity. Moreover, you will receive information on which accounts could not be paid, so you may take the steps to correct the situation.

For the individual/juridical person receiving the payment:

• Funds are received easily and safely - Funds are electronically credited to your account, thereby eliminating the risk of theft or loss.

• Funds may be deposited to the financial entity of your choice, so there is no need to open an account with the same financial entity of the payer.

• Regulated terms for fund crediting - If the financial entity does not credit the amount to the account at the time established in the regulations at most, the client may file a claim. Working HoursPayment transactions are credited the following working day at most. In case a transaction could not be made the financial entity will inform you the reason. Example of UseA company may pay its payroll this service. To this end, it should send its financial entity an electronic file with the Cuenta Iban (regardless of where the company itself and its employees keep their accounts), also indicating the amounts to be credited to each beneficiary. This file should meet the requirements and format required by each financial entity, so that the payments are made through SINPE.

The following information should be provided: ID Card number and Cuenta Iban of the beneficiaries, amount and currency, name and ID card/Incorporation Number of the payer, date when payments should be processed, and any other detail the financial entity may require.

|